Service quality is now THE major concern for parcel delivery companies, outranking issues such as profitability, recruitment and the environment.

But what does “quality of service” mean for parcel delivery players? How do these organizations define it? What are the costs resulting from poor service quality? We’ll also look at how service quality can be improved in last-mile delivery operations.

What is service quality for parcel delivery players?

Service quality in the parcel delivery industry is essential for leading companies, who strive to offer their customers reliable, fast and convenient delivery services.

When it comes to service quality, on-time delivery is key. To meet increasingly demanding customer requirements, many retailers continue to promise speedy delivery, which is sometimes difficult for carriers to achieve. According to a study conducted by project44 (May 2023), on-time delivery dropped from 83.9% to 80.4% in April compared to the previous year, which can have a strong impact on customer satisfaction. This drop is widely attributed to the “aggressive lead times that some companies promise to meet”.

Compliance with the delivery option selected by the customer when ordering (home / POS pick-up / lockers, etc.) is also important. Should delivery fail, carriers must be able to offer flexible solutions to the recipient: allowing for a second home delivery or collection from a point of sale, for example.

Service quality also means making delivery more secure, to avoid theft, loss or damage during transport. A growing number of delivery companies are introducing identity checks (using codes and photos) and secure tracking systems.

But this is no longer enough. Today’s business and private customers expect much more from their deliveries: they value the ability to track their parcels throughout the entire process. Delivery companies need to provide accurate information on transport status, progress and delays, and sometimes even real-time tracking of the driver over the last mile.

A new study by Auctane has found that 78% of consumers are unlikely to buy from a brand again after a negative delivery experience, and 84% are likely to abandon their shopping cart due to a lack of delivery options at checkout. The main obstacles to delivery quality mentioned were high shipping costs (62%), damaged parcels (50.8%) and lost parcels (40.6%).

Standard KPIs for assessing service quality among parcel delivery players

Parcel delivery players use a range of Key Performance Indicators (KPIs) to monitor and measure the quality of their service. Here are some commonly used KPIs:

- Delivery times: time between parcel pick-up and final delivery. Delivery companies monitor average delivery times to meet customer expectations and advertised lead times.

- Successful delivery rate: this KPI measures the percentage of packages successfully delivered out of the total number of packages picked up. A high successful delivery rate reflects better overall company performance. It is the opposite of the loss rate, which measures the share of packages lost during delivery.

- Return rate: share of returned parcels out of total parcels processed. A high return rate may suggest delivery or service problems that must be solved.

- Complaint rate: share of parcels with a complaint compared to the total number of parcels delivered. A high claims rate may suggest service quality problems, such as damaged or lost parcels.

- Customer satisfaction, usually as NPS: Delivery companies can use customer satisfaction surveys to collect customer feedback on their delivery experience. This KPI can be used to measure overall customer satisfaction and identify improvement opportunities.

Costs resulting from poor service quality

Late delivery fees

Late delivery fees are costs charged to delivery companies when a delivery exceeds the deadline agreed with the customer. These fees can be set out in service contracts or service level agreements (SLAs) between the delivery company and its customers.

These fees may vary based on a number of criteria, such as delay duration, parcel value, specific customer requirements and so on. Most often, they involve partial or full refunds of the shipping costs initially paid by the customer, and additional compensation is sometimes possible in the event of long delays or major inconveniences for the customer.

Delay fees are often charged to the delivery company’s transport partners, with no direct financial impact for the courier. However, in a high-pressure market where subcontractors are regularly subject to bankruptcy, this remains a sensitive issue for both parties. Some subcontractors even take out insurance to cover these fees.

💡 For delivery companies, the indirect expenses involved in finding a new subcontractor, negotiating contracts with them and upgrading the skills of their drivers are costs that are difficult to estimate, but should not be overlooked.

Processing complaints

Parcel delivery complaints usually cover various aspects of the service: damaged parcels, lost parcels, late deliveries, incorrect deliveries (wrong address or wrong recipient).

The costs of processing complaints are calculated by multiplying the time spent by customer service to process complaints with the hourly cost of processing a complaint.

💡 The cost of processing a claim is estimated to be between €2.5 (when managed in a call center) and €5 (when managed in-house by the delivery company). When multiplied by the number of complaints per month, the costs of complaint processing can regularly reach several hundred thousand euros per year.

Customer churn from poor service quality

When a delivery company’s service quality is poor or deteriorating, one direct consequence is a higher churn rate, i.e. the number of customers lost over a given period.

Besides the fact that the profit margin generated on these customers is thus lost to the delivery company, this also impacts the company’s long-term reputation and therefore its ability to acquire new customers.

💡 If a parcel delivery company prevents the loss of one of its major customers (400,000 parcels / year) by improving its quality of service, the retained profits will amount to over €75,000 per year.

Optimizing delivery areas to improve service quality

Balance workloads and smooth out parcel volume changes

By optimizing territory sectorization, delivery companies can improve their organization’s service quality. By reducing delivery distances, balancing the workload of delivery drivers, planning better routes and optimizing resource management, they can offer faster, more efficient and more reliable delivery.

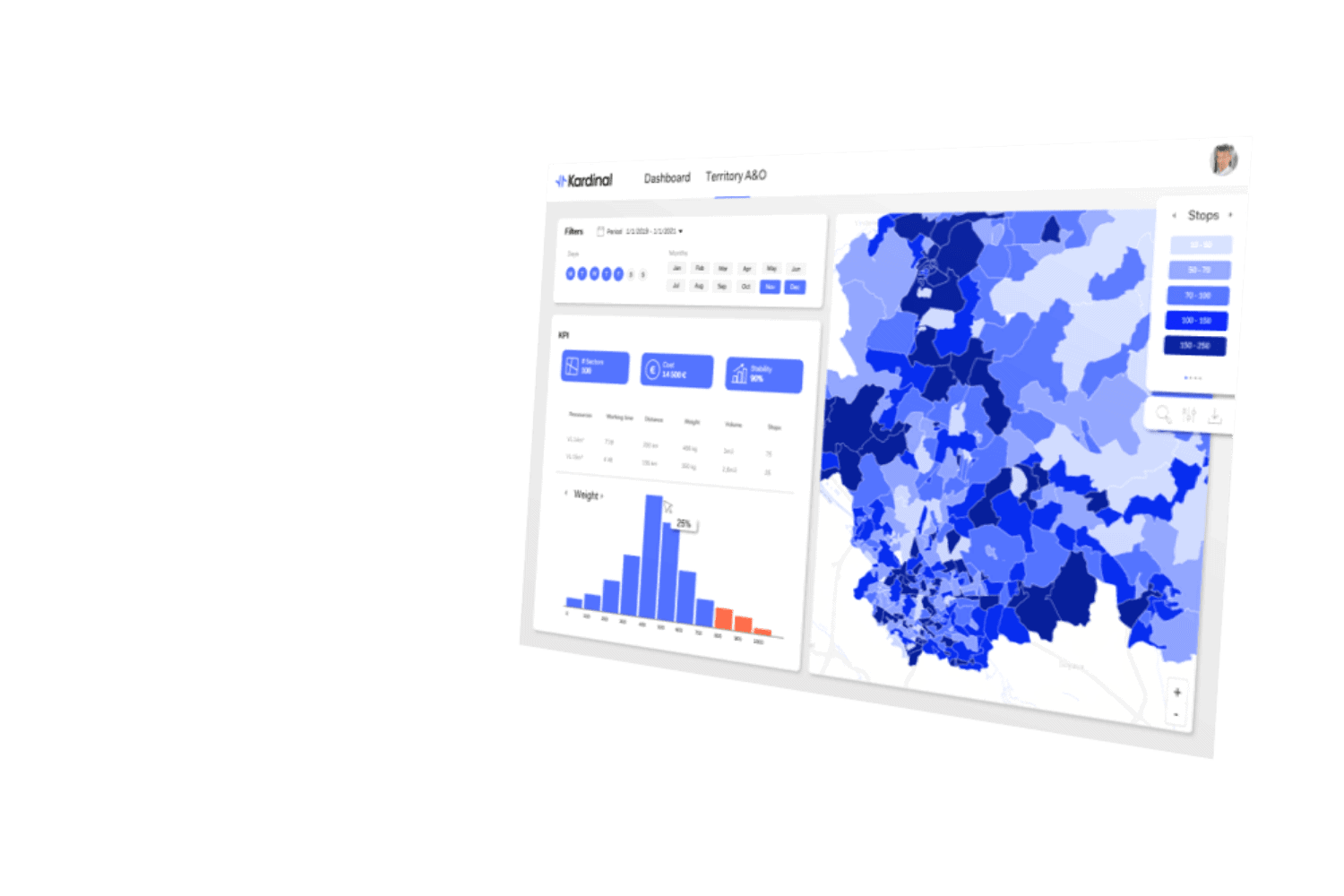

At Kardinal, our sectorization optimization solution specifically addresses these issues. It is based on a unique approach, developed by our Operations Research team based on the latest research on advanced optimization.

Our solution divides the delivery agency’s territory into small areas, studies the distribution of parcel volumes in historical data, and then tests billions of combinations of these areas to find which ones best match each other to form a sector area (one sector corresponds to one delivery route). The resulting areas are therefore highly stable in terms of parcel volumes from one day to the next, from one week to the next, etc., and are also well balanced from one driver to the other.

This approach not only delivers productivity improvements, but also significant improvements in service quality, thanks to a better-balanced route schedule, ensuring that drivers have less stressful and busy days. A better distribution of the workload enables drivers to spend more time with each customer, and prevents “no-shows” and “failed deliveries”.

An example of the impact of advanced sectorization on service quality

As explained above, our unique sectorization calculation methods are based on advanced optimization methods for balancing workloads and creating areas where parcel volumes tend to vary less from day to day and week to week.

Here’s what we found when we studied the distribution of drivers’ working hours before and after the implementation of the new sectorization: after optimization, the distribution of working hours per route is stricter, with fewer very short routes (fewer “empty” vehicles) or very long routes (reduced number of long work days for drivers).

Several weeks after the implementation of the new sectorization, delivery rates improved, stabilizing at 3% above their original value. This rate improvement is substantial, and has had a direct impact on the complaint rate and customer satisfaction (results from a pilot carried out with a leading European parcel delivery company).

In conclusion, service quality is now the main concern of parcel delivery companies, and improving it is essential to meeting new customer expectations, building loyalty and reducing costs. By implementing advanced sectorization, delivery companies can not only improve productivity, but also offer better quality of service with more balanced routes. This enables drivers to spend more time with each customer, reducing undelivered parcels and delivery failures.