Entrusting last-mile delivery to subcontractors has become the norm in the parcel delivery industry. While it offers flexibility and responsiveness, it often comes with challenges: unbalanced routes, overloaded partners, and difficulty retaining drivers.

Often, the root cause is outdated zone allocation that has never been reviewed. Yet, with the right tools, it is possible to reassign zones intelligently, based on concrete data such as volumes delivered, distances, and performance metrics.

In this article, we show how one delivery depot optimized its territorial allocation with Kardinal to reduce costs, balance workloads, and strengthen partnerships.

3 Key Takeaways

Coherent and smooth territories: Zone allocation should respect natural or artificial barriers (highways, rivers, etc.) to ensure logical routes and make drivers’ work easier.

Regularly reevaluate zone allocation: Areas assigned to subcontractors should not remain fixed. Reevaluating based on real data improves route balance and partner satisfaction.

Consider all operational constraints: Vehicle capacities, working hours, traffic, pickup points, and parcel lockers should all be included to ensure realistic, optimized routes.

Last-mile delivery: the essential role of subcontractors

Last-mile delivery increasingly relies on a complex network of actors, with subcontractors playing a central role. In most organizations today, their presence has become the norm rather than the exception. While some operators still rely exclusively on in-house drivers, they are becoming fewer and fewer.

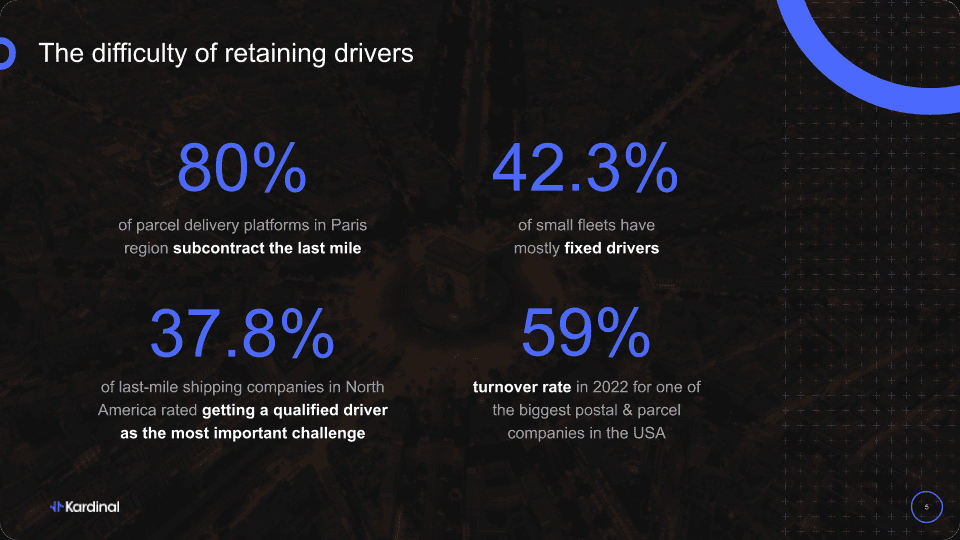

This evolution has accelerated over the past two decades, driven by sustained growth in demand, increased flexibility requirements, and the transformation of technological tools available to field operators. In some cities, such as Paris, it is estimated that 80% of urban parcel deliveries are now handled by subcontractors (study conducted by Mazars and the Île-de-France General Council in 2011).

Subcontractors play a strategic role in the logistics chain: they enable carriers to respond quickly to fluctuations in volume while reducing the fixed costs associated with direct employment. For this model to work, however, it must be based on a balanced, sustainable partnership that satisfies both parties. Without this, service quality issues and driver retention problems can quickly arise.

Today, the stability of these relationships is facilitated by the rise of mobile technologies and field operational apps. Compared to just five or six years ago, the tools available to manage and oversee field operations have improved significantly. This has been a key lever in structuring collaborations between shippers and subcontractors.

Yet this positive trend does not mask the growing tensions in the sector: difficulty recruiting qualified drivers, high turnover (nearly 60% for some major operators), fleet heterogeneity, and more.

For more information on the parcel delivery sector, see our article “How to organize parcel transport networks?”

In this rapidly changing context, territorial organization plays a key role. Yet, the allocation of delivery zones to subcontractors is still far too often fixed, empirical, or inherited from old planning.

However, reassessing these zones based on real data (volumes, geography, operational constraints) can improve both operational performance and the quality of relationships with subcontractors.

Zones optimization: constraints to consider for reliable results

For the optimization of routes and subcontracted territories to be truly useful and credible, it must take into account several constraints, often overlooked in traditional approaches. Some may seem obvious, others more subtle, but all are essential to produce results that reflect the reality on the field and, above all, are actionable for operational teams, whether carriers or subcontractors.

1. Coherent territories, without physical breaks

Zone allocation must respect natural or artificial geographical barriers. For example, it is essential to avoid splitting a zone across a highway or a river, except in very specific cases. This ensures logical and smooth routes, while also providing a better experience for drivers.

💡 A real-world case

In a real case, Kardinal’s algorithm optimized a route by following the docks in the city of Marseille, never crossing east of a major road. Why? Because the passage points were rare and significantly lengthened the drivers’ journey. A classic clustering algorithm would have ignored this constraint, creating an unsuitable sector and, therefore, an unfeasible route.

2. Well-integrated vehicle constraints

Optimization must take into account vehicle capacity (weight, volume, number of parcels) as well as their type: electric or combustion engine, size, range, etc. The right vehicle varies depending on the type of parcels, urban access, and environmental restrictions.

3. Respect for working hours

Drivers’ working hours must be included in the calculations, not just for regulatory reasons but also to ensure a sustainable and realistic workload. This is essential to maintain high performance and reduce turnover.

4. Realistic traffic modeling

Using predictive traffic data allows travel times to be calculated much more reliably. This builds confidence for both shippers and subcontractors, as duration forecasts are not mere estimates but reflect real-world conditions.

5. Integration of pickup points

Pickup points, whether related to B2B, B2C, or C2C flows, are becoming increasingly central. Their location and associated stop times must be properly accounted for to ensure realistic planning without negatively impacting routes.

6. Accounting for locker-specific constraints

Parcel lockers present specific challenges: avoiding overfilling, adjusting plans based on available capacity, and ensuring parcel volumes are compatible with locker sizes. Integrating these factors into optimization calculations is therefore essential to guarantee smooth and efficient delivery.

Why reevaluate the allocation of zones among subcontractors?

In a context where subcontractors play a key role in the success of last-mile deliveries, the way territories are assigned to them can no longer remain fixed. Regular reevaluation of zone allocation is not only relevant but also strategic.

Several factors should be considered when deciding which subcontractor to assign to a particular zone, and to what extent. These include:

- The subcontractor’s location relative to the depot or delivery area.

- Their service performance, measured using objective criteria such as punctuality, first-attempt delivery success rate, or customer satisfaction.

- The stability of their organization and their field experience.

Carriers have every interest in rewarding the most efficient subcontractors by assigning them more volume or zones, creating more durable and motivating partnerships. This is a powerful lever to strengthen loyalty, improve service quality, and ensure the economic viability of the subcontracting model.

Moreover, optimizing zone allocation from the depot helps reduce operational costs, particularly cost per parcel, and improves overall productivity. Territorial allocation can no longer rely solely on empirical decisions; it must be based on precise, reliable, and up-to-date data.

This is where KPIs (key performance indicators) come into play. To make the right decisions, data-driven analysis is essential: actual travel times, consolidated service rates, performance history, etc. This approach allows for a balanced relationship between shippers and subcontractors, based on facts rather than intuition.

[REPORT]

What route optimization to meet the challenges of the parcel delivery industry?

Concrete example: optimized territory reorganization with Kardinal

To illustrate the practical benefits of reevaluating zones, let’s consider a simulated real-world case using the Kardinal solution, in the northwest Nantes region of France.

The context

A depot manager oversees an average of 14 daily routes, distributed among 3 subcontractors. Each day, around 2,046 parcels must be delivered across an area combining dense urban zones and more scattered rural sectors. This is a fairly typical last-mile delivery scenario.

However, a problem persists: the routes are highly unbalanced. Some subcontractors are overloaded, while others have too little work. This creates tension, affects service quality, and weakens the relationship between the delivery depot and its partners.

This situation often results from a legacy organization that has never been questioned: zones are passed from one subcontractor to another over the years, without a real optimization strategy.

The opportunity to rethink zone allocation

With a contract nearing its end, the depot manager wonders: “What if this is the right time to completely rethink how zones are distributed among my subcontractors?”

Thanks to the Kardinal solution, they can now:

- Virtually merge existing territories to simulate a new allocation.

- Reassign zones taking into account concrete operational criteria: volumes, distances, travel times, and workload balance.

- Identify the highest-performing zones to strengthen the position of the most efficient subcontractors.

Simulation results

With just a few clicks, the depot manager runs a full optimization for the area. Based on historical data, the Kardinal algorithm proposes a new allocation:

- 1 route is eliminated (13 routes instead of 14), thanks to better use of available working time.

- 2 subcontractors are retained: one goes from 4 to 5 routes, handling more parcels per route; the other goes from 5 to 8 routes, leveraging its available capacity.

- The average route duration increases from 6h32 to 7h, boosting overall productivity.

- The workload is much better balanced across routes, reducing the gap between long and short routes.

Visually, zone boundaries have been redesigned: some circuits were extended or refocused, while others were centralized around main roads to facilitate distribution.

Tangible benefits

- Immediate cost reduction thanks to the removal of a route and higher load factors.

- Better profitability for the remaining subcontractors, who can absorb more volume in a balanced way.

- A solid foundation for contract renegotiation, with a fairer and more transparent allocation.

- Faster decision-making, where similar adjustments could previously take weeks.

A data-driven approach serving strategy

This case clearly shows how a data-driven approach, supported by a tool like Kardinal, can turn a constraint (a subcontractor leaving) into a strategic opportunity.

This type of analysis can also be applied in many other situations: integrating a new partner, managing a peak in activity, adjusting volume forecasts, or even reconsidering depot locations.

Strategic sectorization solution dedicated to the parcel delivery industry

Conclusion

Optimizing territories and subcontracted resources has become a central challenge. It is no longer just about finding the right balance between costs and capacity, but about creating a collaborative framework where everyone, carrier and subcontractor alike, can commit with confidence over the long term.

To achieve this, one must move beyond a purely volumetric or map-based view of optimization. Tools must reflect real-world conditions, integrate the correct constraints, and adapt to the specifics of each organization. Only then can optimization become a true lever for sustainable performance, benefiting shippers, subcontractors, and ultimately… the end customer.

💡 Ready to transform your operations and optimize your territory allocation?

Contact us today to discover how TAO can adapt to your needs and boost your last-mile performance.

FAQ

1. Why does subcontractor zone allocation become quickly outdated?

Volumes, parcel types, traffic, and even subcontractor capacities are constantly changing. A fixed allocation eventually creates workload imbalances, unrealistic routes, and operational tensions, even if it initially worked well.

2. How often should zone allocation be reevaluated?

There is no single rule, but an annual review is generally recommended, and it should always be done during key events: a subcontractor joining or leaving, significant changes in volumes, fleet updates, or the opening of new pickup points or lockers.

3. How can we ensure a fair distribution among subcontractors?

Fair distribution doesn’t mean equal distribution. It should be based on objective indicators: route duration, number of parcels, distance traveled, vehicle constraints, and past performance. The goal is to ensure a sustainable and comparable workload, not just a similar number of routes.

4. Won’t optimizing zones destabilize drivers?

On the contrary, when done correctly, it improves their daily work. More coherent territories, without geographic splits and with realistic routes, reduce stress, unnecessary mileage, and delays. Transparency and proper communication during changes remain key.

5. What types of data are needed for reliable optimization?

Essential data includes delivery history, actual travel times, volume per zone, time constraints, vehicle characteristics, traffic, and service performance. The more precise the data, the more credible and accepted the results are by field teams.

6. Can optimization be used to renegotiate subcontracting contracts?

Yes, this is actually a common use. A data-based zone allocation helps justify the volumes assigned, provides objective grounds for pricing discussions, and supports the creation of fairer and more sustainable contracts for both parties.

7. How does Kardinal differ from traditional zone allocation approaches?

Kardinal goes beyond simple map-based zoning. The solution integrates real operational constraints (working hours, traffic, capacities, pickup points, lockers, etc.) and allows simulation of different scenarios to make quick, reliable, and actionable decisions on the field.